Broadcom plays a leading role in the semiconductor and telecommunications equipment industry, providing the foundation for modern communication, data processing, and connectivity technologies. With a diversified product portfolio and strong technological capabilities, Broadcom occupies a significant position in the semiconductor and IT infrastructure market.

1. Company Overview

Broadcom was founded in 1961 and has a long history and tradition. After being acquired by Avago Technologies in 2016, the company changed its name to Broadcom, solidifying its position as a leader in the global semiconductor market. Broadcom primarily develops and sells wireless and wired communication, enterprise storage, data centers, networking, broadband, and industrial semiconductor solutions.

2. Core Products and Technologies

Broadcom’s product portfolio spans various industries and applications. The key products and technologies include:

- Networking Solutions: Broadcom supplies semiconductors for data centers, network switches, and routers, which play a vital role in the Internet and cloud infrastructure.

- Wireless Communication and RF Solutions: Broadcom provides wireless chipsets and RF solutions for smartphones and IoT devices, dominating the market in Wi-Fi and Bluetooth chips.

- Broadband: Broadcom’s broadband solutions are used in wired communications, cable modems, satellite, and IPTV systems, playing a crucial role in both home and commercial network connectivity.

- Data Storage: Broadcom offers enterprise storage solutions and controllers for data centers, delivering high performance in cloud and large-scale data processing systems.

- Industrial Semiconductors: Broadcom develops semiconductor solutions for automotive, aerospace, and industrial automation sectors, contributing to the advancement of autonomous vehicles and industrial robotics.

3. Key Business Segments

Broadcom operates in several core business segments, with networking, storage, and wireless communication being the most prominent. In particular, Broadcom holds a critical position in the global networking semiconductor field, supplying essential solutions to cloud service providers and telecom companies.

4. Competitors

Broadcom competes with various global companies across multiple technological fields. Major competitors include:

- Qualcomm: Broadcom and Qualcomm are fierce rivals in the wireless communication chipset market, especially in Wi-Fi and Bluetooth chipsets for smartphones.

- Intel: Intel is a strong competitor to Broadcom in the network infrastructure, data center, and enterprise solutions markets.

- NVIDIA: NVIDIA provides semiconductor solutions for data centers and AI processing, competing with Broadcom in the cloud infrastructure and data center solutions market.

- MediaTek: MediaTek competes with Broadcom in the broadband and wireless communication semiconductor markets.

5. Broadcom’s 20-Year Financial Performance

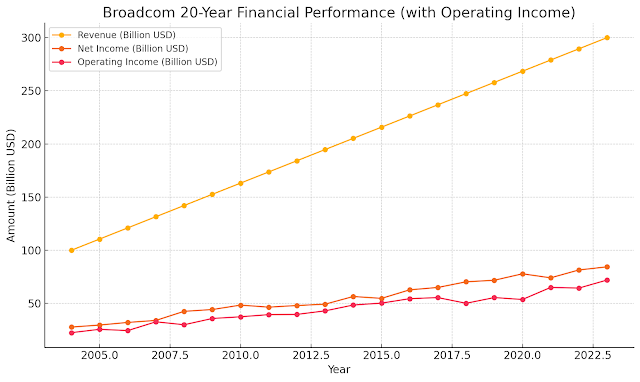

Broadcom has demonstrated strong financial performance over the past 20 years. The chart below illustrates the company's revenue, net income, and operating income during this period.

The chart highlights Broadcom's continuous growth, particularly in the data center and wireless communication segments.

6. Goldman Sachs’ Opinion

Goldman Sachs maintains a positive outlook on Broadcom, particularly seeing continued growth in the data center and networking sectors.

- Buy Recommendation: Goldman Sachs recommends buying Broadcom’s stock, citing the company’s diversified business portfolio and strong financial performance.

- Price Target: Goldman Sachs has raised Broadcom’s price target by approximately 10%, reflecting industry trends such as the expansion of 5G networks and the rapid growth of data centers.

- Risk Factors: However, Goldman Sachs warns that global semiconductor supply chain issues and geopolitical tensions could impact Broadcom’s short-term performance.

7. Future Outlook

Broadcom is expected to see continued growth in data centers, 5G networks, and wireless communication solutions. The increasing demand for chipsets due to the spread of 5G networks, along with the growing need for cloud and AI data processing, will be significant growth drivers for Broadcom. Additionally, demand in the industrial semiconductor sector, particularly for autonomous vehicles and smart factory solutions, is expected to rise steadily.

Conclusion

Broadcom plays a leading role in the global semiconductor and telecommunications technology markets and has consistently delivered strong financial results with its diversified portfolio across various industries. As the importance of data centers and network infrastructure continues to grow, Broadcom’s growth is likely to persist. However, it's essential to closely monitor global supply chain challenges and geopolitical risks, as they could affect short-term performance.